STRATEGY

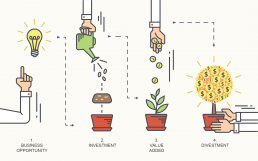

Acquisition of control and minority stakes in unlisted Italian small and medium-sized companies, supporting actively their growth

- GEOGRAPHIC FOCUS: Italy

- SECTOR FOCUS: generalist. Typical industrial sector including “Made-in-Italy” products, such as machinery, mechanical products, luxury and life-style goods, food and beverage, services and consumer goods; strong preference for innovative companies investing in R&D and with advanced patented technologies

- Real Estate: excluded

- Turnaround: soft turnaround only

- Start-up: do not represent the core investment focus of the Company, although business projects with innovative, potentially successful ideas and value proposition as well as potentially disruptive technologies might be taken into account in a residual way

- Limitation to single investments by setting caps and strong attention to risk mitigation

SMEs with turnover indicatively ranging from 5 to 40 M€ revenues

- Interesting and compelling growth strategy

- Excellent cash generating capability and financial stability

- Managers with proven track record and specific skills

- Leadership in the relevant market segment/niche

- High export propensity

Pre-agreed exit strategy and way-out mechanisms, alongside with clear shareholder agreements on terms and conditions of investment and divestment